GREENFIN

The GREENFIN project, funded by an ERC Starting Grant awarded by the European Research Council (EU Commission), started in January 2021.

Mitigating dangerous climate change requires a fundamental transition of global economies. This transition calls for an annual investment of 2–4 trillion USD, which is a multiple of current climate investment. Accordingly, the EU and many countries are enacting green financial policies, intervening in the financial sector to improve financing conditions for low-carbon technologies. Examples include green state investment banks, green finance taxonomies, and changes to lending regulations. However, the effect of these financial policies on investments in non-financial sectors such as energy or transport is largely unknown, and it remains unclear how to make best use of such policies to fill the climate finance gap.

Against this backdrop, the project GREENFIN will combine theory from technology innovation studies and financial economics to derive how different low-carbon technologies require different types of finance, as a starting point for targeted policy interventions. Empirically, novel climate finance datasets will be used, exploiting both structured financial data and unstructured information, drawing on recent advances in machine learning methods (esp. natural language processing). The project aims at delivering specific recommendations for designing more effective green financial policies in the EU and beyond.

CFP Policy Brief No. 7 (2025): Public loans and de-risking can mobilize commercial lending for clean energy. (download Brief here)

Waidelich, P., Steffen, B. (March 2023): The Role of State Investment Banks for Renewable Energy Technologies in OECD Countries. Research Brief for MIT CEEPR Working Paper 2023-07. external page Report website

Klaaßen L., Steffen, B. (January 2023): Europe’s net-zero goal increases infrastructure investment needs. Nature Climate Change Research Briefing. external page Report website

CFP Policy Brief No. 6 (June 2022): Understanding cost of capital drivers facilitates more effective energy policymaking (Download download Brief here (PDF, 260 KB))

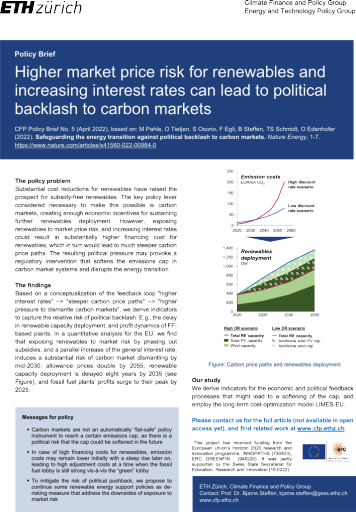

CFP Policy Brief No. 5 (April 2022): Higher market price risk for renewables and increasing interest rates can lead to political backlash to carbon markets (Download download Brief here (PDF, 162 KB))

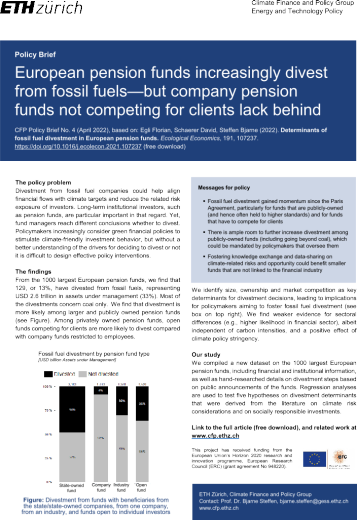

CFP Policy Brief No. 4 (April 2022): European pension funds increasingly divest from fossil fuels—but company pension funds not competing for clients lack behind (Download download Brief here (PDF, 159 KB))

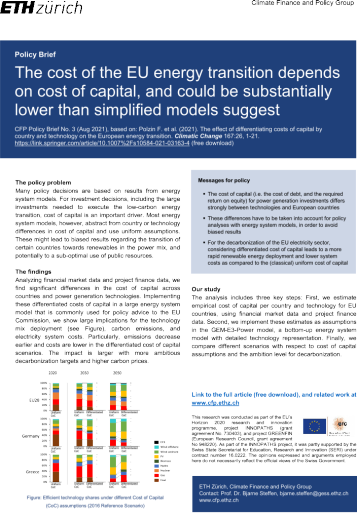

CFP Policy Brief No. 3 (August 2021): The cost of the EU energy transition depends on cost of capital, and could be substantially lower than simplified models suggest (Download download Brief here (PDF, 318 KB))

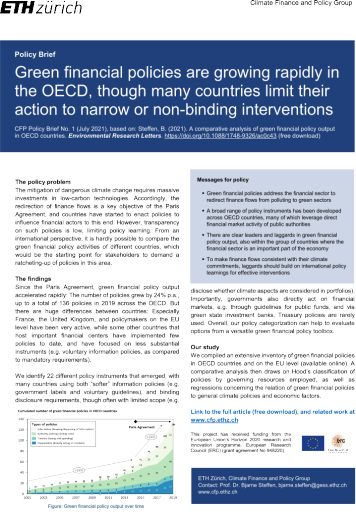

CFP Policy Brief No. 1 (July 2021): Green financial policies are growing rapidly in the OECD, though many countries limit their action to narrow or non-binding interventions (Download download Brief here (PDF, 208 KB))

2025

December 17, 2025: “The risks of climate tipping points for financial investors”, GFRA 2025 conference, Paris/France (P. Waidelich, L. Klaaßen, B. Steffen)

November 04, 2025: “Quantifying the shift of public export finance from fossil fuels to renewable energy”, NEW PATHWAYS webinar, Milan/Italy (P. Censkowsky, P. Waidelich, I. Shishlov, B. Steffen)

July 1, 2025: “A global analysis of green financial policies: Mapping policy output and evidence of effectiveness”, 3rd Conference on Sustainable Finance and Banking (CSBF) 2025, Naples/Italy. (V. de los Casares, B. Steffen)

June 20, 2025: “The risks of climate tipping points for financial investors”, ISCFS 2025 conference, Paris/France (P. Waidelich, L. Klaaßen, B. Steffen)

June 20, 2025: “A global analysis of green financial policies: Mapping policy output and evidence of effectiveness”, ISCFS 2025 conference, Paris/France. (V. de los Casares, B. Steffen)

June 18, 2025: “The impact of financing conditions on global deep decarbonization”, IAEE 2025 conference, Paris/France (P. Waidelich, C. Crassier, H.S. de Boer, B. Steffen)

2024

November 21, 2024: “Mobilizing credit for clean energy: De-risking & public loan provision under learning spillovers”, 2024 International Symposium on Climate, Finance, and Sustainability, Paris/France (P. Waidelich, J. Krug, J. Steffen)

July 3, 2024: “The risks of climate tipping points for financial investors”, 29th Annual Conference of the European Association of Environmental and Resource Economists, Leuven/Belgium (P. Waidelich, L. Klaaßen, S. Battiston, B. Steffen)

July 25-28, 2024: “Towards Deep Decarbonization: Financing of CO2 Transport in Europe”, 45th IAEE International Conference, Boğaziçi University, Istanbul/Türkiye (K. Sievert, A. Stefanescu, P. Oeuvray, B. Steffen)

June 27, 2024: “Energy finance via public export credit agencies: Trends and implications amidst the climate crisis”, 45th IAEE International Conference, Boğaziçi University, Istanbul/Türkiye (P. Censkowsky, P. Waidelich, I. Shishlov, B. Steffen)

June 11, 2024: “Systematic review of the effectiveness of green financial policies in re-directing finance flows in line with the Paris Agreement”, What Works Climate Solutions Summit 2024, TU Berlin, Berlin/Germany. (V. de los Casares, B. Steffen)

April 17, 2024: "The risks of climate tipping points for financial investors", EGU24 General Assembly, Vienna/Austria (P. Waidelich, L. Klaaßen, S. Battiston, B. Steffen)

2023

July 26, 2023: "Do interest rates matter for the transition? The role of cost of capital in energy system models", 18th IAEE European Conference, Milan, Italy (B. Steffen, K.E. Lonergan, F. Egli, S. Osorio, G. Sansavini, M. Pahle, T.S. Schmidt)

July 25, 2023: "The Role of State Investment Banks for Renewable Energy Technologies in OECD Countries", 18th IAEE European Conference, Milan, Italy (P. Waidelich, B. Steffen)

July 25, 2023: "Global Analysis of Renewable Energy Project Commissioning Timelines", 18th IAEE European Conference, Milan, Italy (A. Gumber, R. Zana, B. Steffen)

July 6, 2023: "The role of finance for clean energy and development: The case of electrification in sub-Saharan Africa", Forest-Water-Energy Interdisciplinary Workshop, Paris, France (B. Steffen, C. Agutu, F. Egli, N.J. Williams, T.S. Schmidt)

July 3, 2023: "Climate damage projections beyond annual temperature", NAVIGATE-ENGAGE Summer School 2023, Como, Italy (P. Waidelich, F. Batibeniz, J. Rising, J.S. Kikstra, S.I. Seneviratne)

June 29, 2023: "The Role of State Investment Banks for Renewable Energy Technologies in OECD Countries", 28th Annual Conference of the European Association of Environmental and Resource Economists, Limmasol, Cyprus (P. Waidelich, B. Steffen)

June 29, 2023: "Mobilizing credit for clean energy: De-risking & public loan provision under learning spillovers", 28th Annual Conference of the European Association of Environmental and Resource Economists, Limmasol, Cyprus (B. Steffen, P. Waidelich, J. Krug)

May 25, 2023: "Differentiating the good from the bad – an investor perspective on the informative value of corporate climate disclosure", 9th International Symposium on Environment and Energy Issues, Paris, France (L. Klaassen, C. Lohmüller, B. Steffen)

May 25, 2023: "The role of policies in reducing the cost of capital for offshore wind", 9th International Symposium on Environment and Energy Issues, Paris, France (M. Dukan, A. Gumber, F. Egli, B. Steffen)

May 9, 2023: "The Role of State Investment Banks for Renewable Energy Technologies in OECD Countries", 11th Mannheim Conference on Energy and the Environment, Limmasol, Cyprus (P. Waidelich, B. Steffen)

May 3, 2023: "Investitionen in Energieinfrastruktur: Was ändert sich durch «Netto-Null 2050» und den Ukraine-Krieg?", 32. Fachanlass Institutionelle Anleger der TKB, Weinfelden, Switzerland (B. Steffen)

May 2, 2023: "Member of panel discussion", Book Launch Event: Financing the future, Zurich, Switzerland (B. Steffen)

March 7, 2023: "Infrastructure investment needs in Europe", Investor event, Zurich, Switzerland (L. Klaassen, B. Steffen)

February 16, 2023: "Nötige Investitionsverlagerungen in Europas Infrastruktur für das Erreichen von Netto-Null-Pfaden", 13. Internationalen Energiewirtschaftstagung, Vienna, Austria (L. Klaassen, B. Steffen)

February 16, 2023: "The Role of State Investment Banks for Renewable Energy Technologies in OECD Countries", 13. Internationalen Energiewirtschaftstagung, Vienna, Austria (P. Waidelich, B. Steffen)

February 16, 2023: "Costs of capital for low-carbon technologies", 13. Internationalen Energiewirtschaftstagung, Vienna, Austria (M. Dukan, B. Steffen)

February 16, 2023: "The role of cost of capital in energy system models", 13. Internationalen Energiewirtschaftstagung, Vienna, Austria (B. Steffen, K.E. Lonergan, F. Egli, S. Osorio, G. Sansavini, M. Pahle, T.S. Schmidt)

January 17, 2023: "Which infrastructure investment shifts are needed to reach net zero pathways in Europe?", Pension fund event, Zurich, Switzerland (B. Steffen, L. Klaassen)

2022

November 17, 2022: "The Effectiveness of Green State Investment Banks for the Deployment of Novel Clean Energy Technologies", APPAM Fall Research Conference, Washington D.C., USA (B. Steffen, P. Waidelich)

October 4, 2022: "The crucial role of climate finance", Academy of the Global Climate Partnership Fund, Zurich, Switzerland (B. Steffen)

September 30, 2022: "Market-financed large-scale solar power without support schemes?", ENERDAY Conference, Dresden, Germany (A. Gumber, D. Keles, C. Fraunholz, D. Moest, B. Steffen)

September 27, 2022: "All about money? How finance matters for the clean energy transition", Public lecture, Zurich, Switzerland (B. Steffen)

July 8, 2022: "Why finance matters for renewable energy deployment", Tsinghua PBCSF Green Finance Lectures, webinar (B. Steffen)

June 30, 2022: "An effective transition to renewable energy in Europe: carbon markets, interest rates, and political backlash", EAERE Conference, Rimini, Italy (B. Steffen, M. Pahle, S. Osorio, O. Tietjen, F. Egli, T. Schmidt, O. Edenhofer)

June 28, 2022: "The role of public ownership in the development of low-carbon energy", UCL IIPP “Shifting Narratives” Conference, London, United Kindgom (B. Steffen, V. Karplus, T.S. Schmidt)

June 24, 2022: "Credit provision for immature low-carbon technologies: Assessing green state investment bank under experience feedbacks", 9th Atlantic Workshop on Energy and Environmental Economics, A Toxa, Spain (P. Waidelich, J. Krug, B. Steffen)

June 23, 2022: "Renewable energy finance: an academic view", Offshore wind energy financing workshop, New York City, USA (B. Steffen)

June 22, 2022: "Fit for 55? Contrasting green infrastructure investment needs in Europe with the EU’s sustainable finance strategy", FSR Sustainability Conference on “Greening Infrastructures”, Florence, Italy (L. Klaassen, B. Steffen)

May 12, 2022: "Credit provision for immature low-carbon technologies: Assessing green state investment bank under experience feedbacks", 29th Young Energy Economists and Engineers Seminar, Gent, Belgium (P. Waidelich, J. Krug, B. Steffen)

March 3, 2022: "Die Rolle von Finance für die Transformation zur Klimaneutralität", 11. Forum Klimaökonomie, Berlin, Germany (B. Steffen)

2021

November 4, 2021: "Lessons learned from Paris Alignment of multilateral development banks", UNFCCC Climate Conference COP26 (Official Side Event), Glasgow, United Kindgom (B. Steffen)

September 8, 2021: "Net zero transition‘s impact on finance", ETH Zurich Industry Day, Zurich, Switzerland (B. Steffen)

July 20, 2021: "Automated Identification of Climate Risk Disclosures in Annual Corporate Reports", 38th International Conference on Machine Learning ICML, online (B. Steffen, D. Friederich, L.H. Kaack, A. Luccioni)

July 7, 2021: "Accounting for finance in electrification models for sub-Saharan Africa", Seminar Series Energy & Finance, House of Energy Markets and Finance, Essen, Germany (B. Steffen, C. Agutu, F. Egli, N.J. Williams, T. Schmidt)

June 23, 2021: "The Impact of Electric Utility Ownership Structures on High- and Low-Carbon Investment Decisions", 26th Annual Conference of the European Association of Environmental and Resource Economists (EAERE), online (B. Steffen, V. Karplus, T. Schmidt)

June 7, 2021: "The impact of electric utility ownership structures on low-carbon investment decisions", 1st International Association for Energy Economics (IAEE) Online Conference, online (B. Steffen, V. Karplus, T. Schmidt)

Funded by the European Union (ERC, GREENFIN, 948220). Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Research Council Executive Agency. Neither the European Union nor the granting authority can be held responsible for them.